Calculate your employees salary on a centralized Business4x Payroll Module

From calculating salaries and taxes to managing employee bonuses and deductions, administrative payroll tasks and manual payroll management can be pretty challenging for an accounts manager. What if you had a tool to automate these processes.

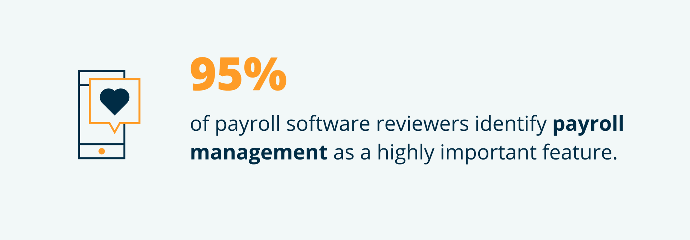

Payroll management

Payroll management automates and streamlines the process of paying employee wages. This typically includes functions such as calculating gross wages based on hours worked, calculating and deducting taxes, and setting up automatic clearing house (ACH) payments for employees. Payroll management software also covers tracking employee vacation and sick time, generating attendance reports, and ensuring tax compliance.

What business problem does payroll management solve?

Manual payroll management may lead to payment calculation errors or inaccuracies in the tracking of employee hours and benefits. An automated payroll system streamlines the calculation of gross wages, taxes, employee benefits, and other deductions, reducing the likelihood of errors and ensuring that employees are paid correctly.

Additionally, compliance with tax laws and regulations is crucial for any business, as noncompliance can result in penalties and fines. A payroll management feature ensures that businesses are compliant with all relevant laws and regulations, avoiding any potential legal issues.

Ideal users of the payroll management feature

If your business lacks an accounting team and relies on HR personnel or a payroll administrator to handle payroll, this feature is a perfect solution. It will enable finance professionals to process payments for all employees quickly and easily, reducing the time spent on manual payroll processing tasks.

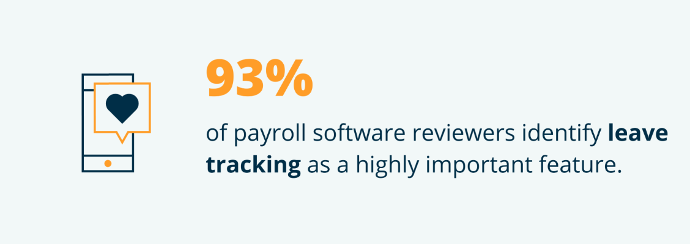

Leave tracking

The leave tracking feature in payroll solutions helps businesses track and manage employee leave requests and time off. This payroll feature allows employees to submit leave requests and managers or HR representatives to view, approve, or reject them. This feature also keeps track of the status of each request and updates the employee's leave balance accordingly.

What business problem does leave tracking solve?

Manually tracking employee leaves and time off can be time-consuming and prone to errors. A leave tracking feature automates the process, reducing the likelihood of errors and ensuring that employee leave is tracked accurately.

Similarly, businesses need to comply with different laws related to employee leave, such as the Family and Medical Leave Act (FMLA) in the US. Leave tracking can help ensure compliance with these laws by tracking employee leave and generating attendance reports that can help with compliance.

Ideal users of the leave tracking feature

If you’re an HR professional or manager looking to eliminate paper-based time-off processes, the leave tracking feature is ideal for you. You can use this feature to not only approve or reject leave requests but also create automated approval workflows for efficient management of attendance, time sheets, and calendars.

Payroll reporting

The payroll reporting feature in payroll software enables users to view and track pertinent metrics to create payroll reports containing information on employee earnings, deductions, contributions to employee benefit programs, and taxes. Some payroll software systems may also offer customizable report templates and report generation, as well as scheduling automation. These reports can be used for compliance purposes, as well as for tracking and analysing payroll data.

What business problem does payroll reporting solve?

The payroll reporting feature helps businesses prevent penalties and fines by staying compliant with legal and tax requirements. Additionally, automating the process of generating and distributing payroll reports can save a significant amount of time and resources compared to manual processes. Having accurate and transparent records of employee pay and benefits can help foster trust and transparency within the organization.

Ideal users of the payroll reporting feature

Payroll reporting enables finance professionals and payroll administrators track and analyze payroll expenses, which can help them make informed decisions about budgeting and forecasting.

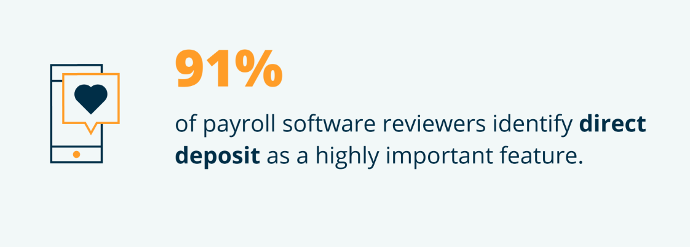

Direct Deposit

The direct deposit feature in payroll software allows users to deposit payroll amounts from company accounts into individual employees' bank accounts digitally, allowing organizations to distribute employee pay checks easily and securely. This feature is typically used as an alternative to issuing paper checks or cash payments to employees.

What business problem does direct deposit solve?

Direct deposit eliminates the need for physical checks and helps reduce the risk of fraud or error. Furthermore, this feature also helps businesses improve record-keeping. It keeps track of all payments made and generates various payroll-related reports. This makes it easier for businesses to track and analyse payroll expenses and improve the overall transparency and accuracy of the payroll process.

Ideal users of the direct deposit feature

If you are an accounting or finance professional responsible for making regular payments to employees or other individuals, you can benefit from the direct deposit feature.

Macro-level Strategies

Make strategic and operational decisions based on vast amounts of reports and forecasts generated by Bsuiness4x. Discover trends hidden in the data and utilize them to recognize and pursue new business opportunities.

Tax compliance

The tax compliance feature helps process tax-related transactions and assists in reporting and filing federal, state, and local taxes. This feature helps users remain compliant with tax obligations and avoid tax penalties. Some payroll software solutions also streamline year-end reporting and preparation of tax forms, such as W-1 (employee’s wage and tax statement) and 1099-NEC (nonemployee compensation form).

What business problem does tax compliance solve?

The tax compliance feature in payroll platforms helps businesses comply with tax regulations by automating the calculation and withholding of taxes from employees' pay checks and then timely submitting them to appropriate government agencies. This helps businesses avoid fines and penalties for noncompliance and can also reduce the administrative burden and time required to manage taxes manually.

Ideal users of the tax compliance feature

If you are a finance professional responsible for tax filing and preparation, tax compliance features can help you prepare year-end reports and file taxes while ensuring a business’s financial reporting practices comply with Internal Revenue Service (IRS) regulations.

100+ companies run Business4x to grow their businesses.

Join us and make your company a better place.